new mexico pension taxes

A new state law eliminated the state income tax on Social Security benefits for most retirees starting with the 2022 tax year. House Bill 67 Tech Readiness Gross.

New Mexico Retirement Tax Friendliness Smartasset

Ad Learn how a lump sum pension withdrawal may give you more income flexibility.

. E-File Directly to the IRS State. New Mexico Veteran Financial Benefits Income Tax. This is meaningful tax relief that.

In late 2021 North Dakota eliminated the tax on Social Security benefits. Beginning with tax year 2022 most seniors will be exempt from paying taxes on their Social Security benefits when they file their New Mexico Personal Income Tax returns. Is my retirement income taxable to New Mexico.

Does New Mexico offer a tax break to retirees. Like the federal tax system the Land of Enchantment uses brackets. 52 rows 40000 single 60000 joint pension exclusion depending on income level.

The exemption increase will take place starting in January 2021. To help with your pre-move research click on any state in the map below for a detailed summary of state and local taxes on retirement income real property every-day. Increased the exemption on income from the state teachers retirement system from 25 to 50.

Should you consider a lump sum pension withdrawal for your 500K portfolio. Active duty military pay is tax-free. Otherwise New Mexico treats Social Security benefits for tax purposes in the same way as other income.

New Mexico is one of only 12 remaining states to. House Bill 39 GRT Deduction for Nonathletic Special Events. Will be subject to a 59 percent tax rate.

Ad E-File Federal to the IRS for Free and Directly to New Mexico for only 1499. The bill would support retired veterans by. Free 2021 Federal Tax Return.

Disabled Veteran Tax Exemption. New Mexico allows you to exclude your retirement income of up to 8000 based off of your filing status and your federal adjusted. This includes employers of some agricultural workers.

In 2022 the New Mexico Legislature passed a bill and the Governor signed that eliminates taxes on Social Security benefits for individuals with less than 100000 in annual income or couples. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to. SANTA FE HB 76 passed the House Labor Veterans and Military Affairs Committee with unanimous bipartisan support.

For tax year 2021 that. Rules for filing taxes in New Mexico are very similar to the federal tax rules. Any veteran who rated 100 service-connected disabled.

Railroad Retirement benefits are fully exempt but New Mexico taxes Social Security benefits pensions and retirement. New Mexico does have a state income tax. Federal Income Tax Deduction.

An employer who withholds a portion of an employees wages for payment of federal income tax must withhold state income tax. None Retirement Income Taxes. New Mexico is one of 12 states that tax Social Security at some level.

It allows individuals aged 65 and over with a GDI of 51000 or less for. Deductions both itemized and standard match the federal deductions. Ad Learn how a lump sum pension withdrawal may give you more income flexibility.

Governor enacts tax cuts for New Mexico seniors families and businesses. Should you consider a lump sum pension withdrawal for your 500K portfolio.

The Most Tax Friendly States To Retire Cheyenne Wyoming Wyoming Best Cities

Are Foreign Pension Plan Income Taxable In Us New 2022

Pin By Nick Miner On Graphic Design Typography Illustration Graphic Design Logo Vintage Typography Graphic Design Typography

Your Social Security Pension Could Increase By More Than 1 800 Per Month

States That Don T Tax Retirement Income Personal Capital

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Our Retirement Budget Is 38 000 A Year So We Can T Afford To Stay In California Where Should We Move Marketwatch

Do You Pay Taxes On Pensions From The State You Retired In Or The State You Re Living In

State Pension Changes 2019 What Is It And What S Different Than Last Year Pensions How To Plan Retirement Planning

Have A Foreign Pension And Repatriating Expat Tax Advice You Need

The U S Is A Low Tax Country Tax Us Tax Budgeting

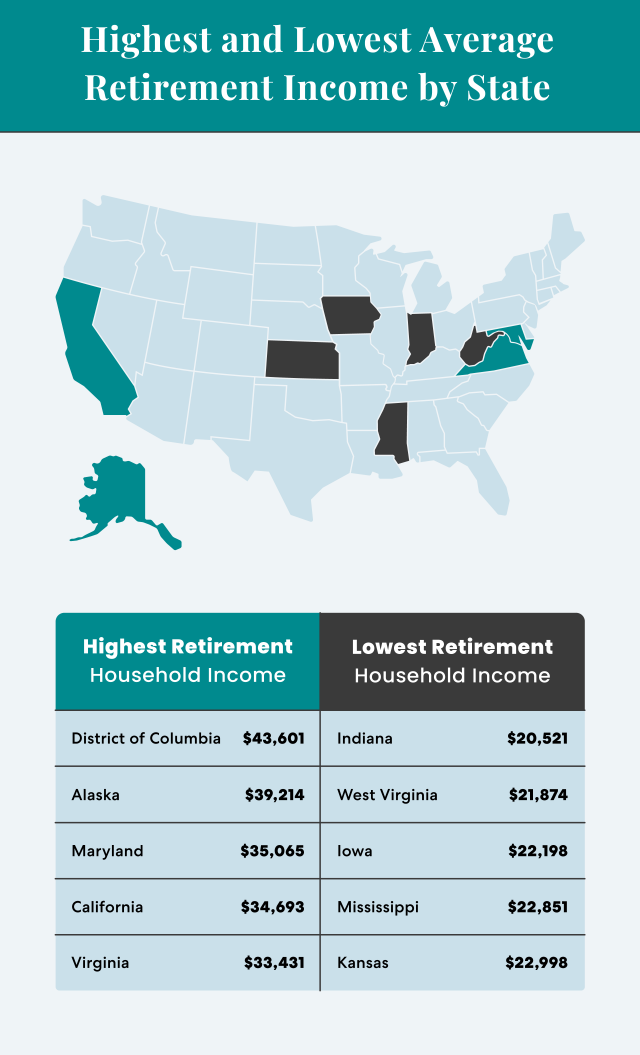

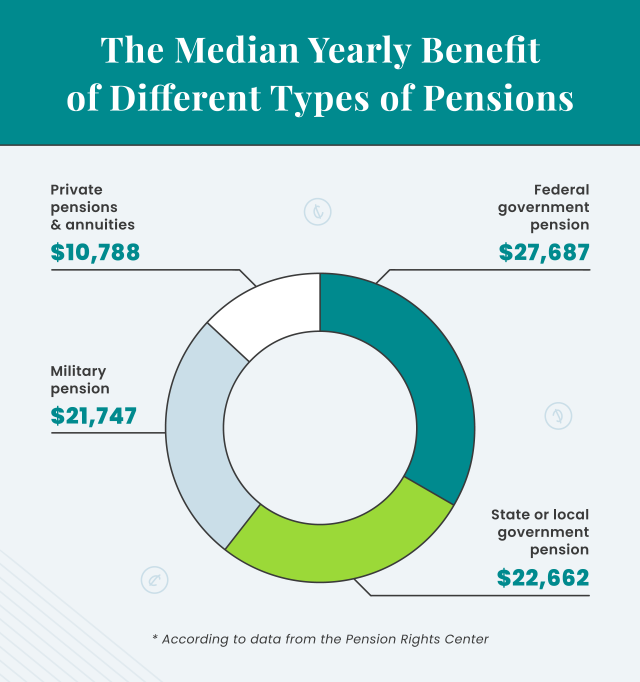

Average Retirement Income Where Do You Stand

Richest 1 Took 38 Of New Global Wealth Since 1995 The Bottom Half Got Just 2

Average Retirement Income Where Do You Stand

Trends In College Pricing Highlights

Portugal Pension Income Tax Of Non Habitual Residents Kpmg Global