hawaii general excise tax id number

Hawaii is probably one of the states where youll need a tax identification number. If you operate a business in partnership LLC or corporation with over one member you will definitely need your own tax ID.

How To File And Pay Sales Tax In Hawaii Taxvalet

After August 15 2016 the new system will be used to administer general excise GE transient accommodation use sellers collection rental motor vehicle and county surcharge tax.

. I like to say that GE is a serial number starting with 999999. This tax is the responsibility of the business to pay but most businesses will pass this tax on the purchaser in the same way a sales tax is. What is the tax.

Hawaii Tax ID Number Changes The Department of Taxation is moving to a new integrated tax system as part of the Tax System Modernization Program. From the letter W and after ten digits is the beginning of the Hawaii Tax IDs issued as part of the modernization project. Tax accounts that have been upgraded will be distinguished by a new Hawaii Tax ID starting with a two-letter account type identifier and 12 digits.

Examples are GE numbers 9999-9999-01 and 99999-000-02. If your Hawaii business pays wages to individuals in the past or if it pays wages to individuals in Hawaii in the past you can find your Tax ID by receiving a notice from the Hawaii Department of Taxation including the Withholding Tax Return Form HW-14 or calling 800 222-3 There are three sizes of Hawaii Withholding ID numbers based on the following format WH. There is a General Excise designation assigned to all sales tax-related.

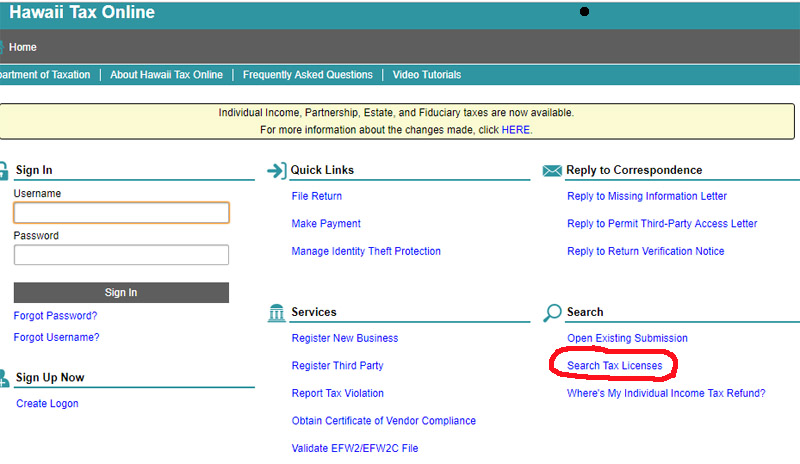

General Excise Tax GET Information Department of Taxation tip taxhawaiigov. Check on whether a business or individual has a general excise tax license with the State of Hawaii Department of Taxation. General Excise Tax License Search.

Our old system assigned a Hawaii Tax ID starting with the letter W followed by 10 digits. Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits. The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others.

Check out the rest of this guide to find out who needs a General Excise. Hawaii does not have a sales tax but instead has a gross receipts tax which is called the General Excise Tax. Those SalesTax IDs that are issued under the Modernization Program should begin with the letters GE and then include a 12 digit code.

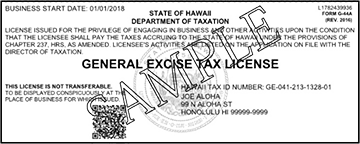

The ID assigned to all sales tax related accounts begins with GE General Excise as its tax type. In October 2004 however a new Hawaii Tax Identification Number replaced the old 8-digit license number following the implementation of the Departments new integrated tax information management system. To learn more about the differences between the GET and sales tax please see Tax Facts 37-1 General Excise Tax GET.

The Hawaii SalesTax ID card that is issued after the modernization project with a 13 letter heading is titled GE. Hawaii Tax ID Number A tax account with a two alpha character tax type prefix followed by a ten digit Hawaii tax identification number 12 total characters. If you are stopping your business temporarily you can request to put your general excise tax transient accommodations tax rental motor vehicle tour vehicle and car-sharing vehicle surcharge tax and withholding tax licenses on hold using Form L-9An account may be put on Inactive status for up to two 2 years.

August 16 2021. 16 Can I add tax licenses to my Hawaii Tax ID. The GET is similar to a sales tax but is actually a privilege tax based on the gross income of most business activities in the State of Hawaii.

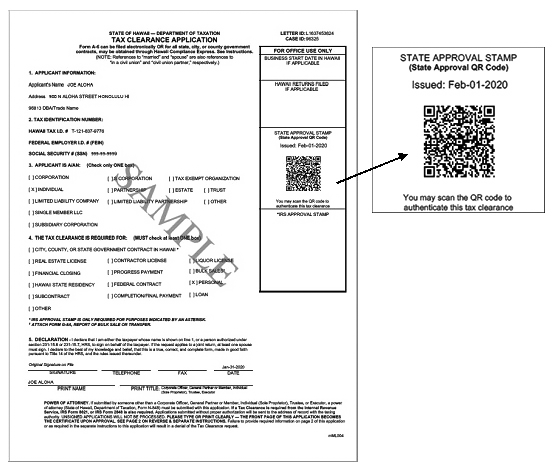

Where Is The Hawaii Tax Id Number Ge. It has been noted that sales tax account IDs start with the letter GE. The General Excise Tax license is obtained through the Hawaii Department of Taxation as a part of applying for a Hawaii Tax Identification Number.

This excise tax is for the privilege of doing business in the State of Hawaii. GE-999-999-9999-01 All sales tax related account IDs begin with the letter GE to reflect the tax type. GET is levied on gross receipts or gross income derived from all business activities in the State.

For example if you are paying for the tax due for general excise taxes for the month of January 2019 the date would be reported as 190131. This tax is the responsibility of the business to pay but most businesses will pass this tax on the purchaser in the same way a sales tax is. You should not enroll in AutoFile using a Hawaii Tax ID that begin with abbreviations for other tax types such as CO.

If you have more than one DBA complete Form G-50 General Excise Branch License Maintenance Form to get a branch license for each DBA you use. Tax ID numbers arent mandated nationwide for most businesses but you are still required to have one in case of disaster or other unfortunate circumstance. The tax rate is 015 for Insurance Commission 05 for Wholesaling Manufacturing Producing Wholesale Services and Use Tax on Imports For Resale and 4 for all others.

Hawaii does not have a sales tax but instead has a gross receipts tax which is called the General Excise Tax. An extension for an additional two 2 years may be. 2006-15 General Excise Tax GET and County Surcharge Tax CST Visibly Passed on to Customers 2018-14 Kauai County Surcharge on General Excise Tax and Rate of Tax Visibly Passed on the Customers 2018-15 Hawaii.

In sales tax related account IDs the letter GE indicates the tax type. GE-999-999-9999-01 All sales tax related account IDs begin with the letter GE to reflect the tax type. How Do I Find My Hawaii General Excise Tax Number.

Here is a sample GE code. After the modernization project Hawaii SalesTax IDs are issued which are issued after the modernization project begin with the letters GE and are followed by 12 digits. With local taxes the total sales tax rate is between 4000 and 4500.

Selling Tax Cards issued in Hawaii after the modernization project which have a GE in the address and twelve digits in the middle. The case study is W99999999-01. Prior to October 2004 persons registered for the general excise tax were assigned an 8-digit license number.

3 rows Old Hawaii Tax ID Number Format New Hawaii Tax ID Number Format. For more information see Tax Facts No. See Hawaii Tax ID Number Changes for more information.

Hawaii General Excise Tax Sales The State of Hawaii does not impose a sales tax on the buyer but a general excise tax GET is levied upon the seller. Branch licenses are free. 37-1 General Excise Tax GET and Tax Announcement Nos.

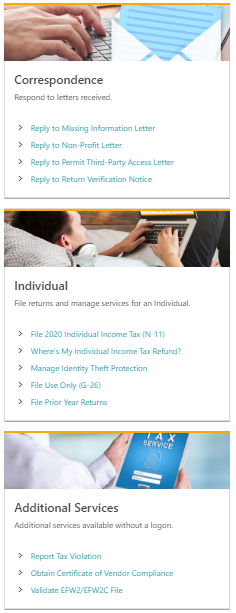

It offers a number of online resources for consumers including licensee status and licensing complaints tax and business registration and other educational materials. With local taxes the total sales tax rate is between 4000 and 4500. If you have a Hawaii Tax ID you can add tax licenses such as employers withholding transient accommodations cigarette.

Perfect answer Hawaii SalesTax IDs that are issued after the modernization project begin with the letters GE and are followed by 12 digits. Year month and day YYMMDD format.

Celeste The Cat Boss Bookstore Cats Bookstore Children S Books

How To File And Pay Sales Tax In Hawaii Taxvalet

Hawaii General Excise Tax Everything You Need To Know

What S New To Hawaii Tax Online Department Of Taxation

Hawaii General Excise Tax Everything You Need To Know

Filing Hawaii State Tax Things To Know Credit Karma Tax

Licensing Information Department Of Taxation

Economic Nexus Hawaii General Excise Tax And Providing Services In Hawaii Tax Solutions Lawyer

County Surcharge On General Excise And Use Tax Department Of Taxation

Hawaii Income Tax Hi State Tax Calculator Community Tax

Hawaii Rental Application Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Forma Rental Application Templates Hawaii Rentals

Setting Up Sales Tax In Quickbooks Online